|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The following article appeared first in the Rayon Yarns, but this version appeared in the company's publication, "Better Living" - July-August 1949 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| HENRY BECOMES A CAPITALIST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rayon Operator Shows How He and Millions of Other Get to Be the Owners of Industry | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

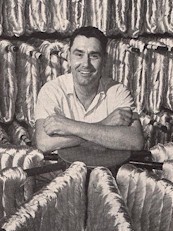

Rayon worker Henry Bagsby shows his wife certificate for the stock which he owns in DuPont Company |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The capitalist is

frequently portrayed as a man of ample girth, wearing a top hat and

frock coat, with bills of large denominations spilling out of his

pockets.

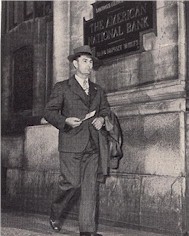

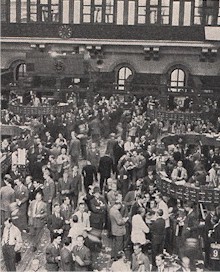

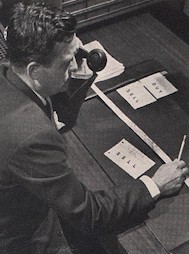

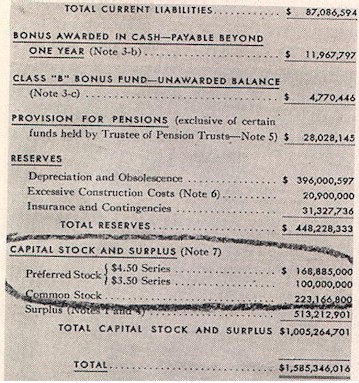

Actually, a capitalist is anyone who owns a share of the tools of production. Today that embraces millions of Americans from all walks of life who have invested their savings in the securities of U.S. Industries. Some become capitalists directly, by buying their stock of concern. A much larger number become capitalists indirectly, through savings accounts, insurance policies and memberships in numerous organizations which own industrial stocks. Strange as it seems, the purchase of a share of stock to become a capitalist is a mystery to many. The language and workings of the stock market seem complex and forbidding. The fact is that a share of stock can be bought as simply as a washing machine. To show how a purchase is made, Better Living asked Henry Bagsby, an operator at Old Hickory and a Du Pont stockholder, to retrace the steps through which he purchased his stock. Those steps and the things which result from acquiring stock are shown on the following pages. Bagsby, the father of six, has owned stock in the Du Pont Company since 1939.

"THE BASIS OF PROGRESS THRIFT" "Since 1924," said Du Pont President Crawford H. Greenewalt in a recent speech, "each year has seen us become more dependent upon the new tools of production than the last. We have made progress only because we have been willing, individually and collectively, to invest more and more money in providing these tools of production. Since 1924 the investment in American industry has been nearly doubled. "So we see that the basis of our progress is thrift. It is the willingness of our citizens to deny themselves in order to save, to employ those savings in adding to our stockpile of productive tools, and through that investment in the country's enterprises to provide a source of income for the the future security of the entire nation. "But back of that willingness to save, to invest, to risk those savings in industiral ventures is the hope of a profit. Remove that profit motive and we destroy all hope and future prosperity. No one would buy a savings bond or mortgage that paid no interest. No one would accept the much greater risk of investment in industry without expectation of profit. "It is the enlightened self-interest of millions of thrifty people that has made this country grow, plus the freedom we have as individuals to reap and to retain the fruits of our industry and our savings." These pages show Henry Bagsby practicing thrift to become an American capitalist.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||